Financial

- Despite being in business for ten years, there is a ridiculous misconception that Zerodha does not have a revenue model. This is ridiculous because it is transparently displayed on our website and the legal documents that clients do at the time of sign onboarding that we offer free equity investment and 20 / trade or 0.03% for intraday and F&O trades ( Whichever is less) charge.

- We are probably the world’s largest retail broker by number of trades. While Charles Schwab (the largest broker in the US with $ 4 trillion in AUM) recently held a record 2+ million Trade reported, we are processing over 7 million trades a day. While most of these trades do not generate revenue for us, but those that do make us one of the most profitable brokerage firms in India.

- At the group level, our own capital in the business is over Rs 800 crore, all generated organically. We are among the most well-capitalized brokerage firms in the country, which are not operated by large banks.

- We have neither debt nor external borrowings.

- Since less than 5% of our own capital is lent to customers, there is no credit risk.

Technology

- We have been manufacturing technology on our own for seven years and reducing external vendor dependencies which are extremely common in the industry. We are probably the only broker now with just an external dependency (such as a refinitive order management system for most management brokers). Here too, we are trying a considerable amount to reduce the last remaining regions of external dependence.

- We have complete control of our technology and data that we keep inhouse and are also able to make rapid changes to comply with increasingly stringent trading, data and security regulations. Our technology stack is also constantly updated to modern standards.

- We are working on building a whole new security / authentication architecture for all our apps to protect our customers from the growing cases of phishing scams. We will announce this soon. For the time being in our platforms Cryptographic TOTP 2FA Support, and we are the only broker to offer this.

- The trading platforms we have developed incorporating good design, simplicity and usability are a major reason for growth in our client base through word-of-mouth. Our products speak for themselves.

- The scale of our system is not comparable to any other broker in India. During peak market activity, we broadcast more than 16 million worth of tickets every second to logged-in customers. In the last financial year, we have processed around one billion retail trades.

- The top five (or more) other brokers have been experiencing declines and disturbances every day for more than two months. This can be clarified by frequent user complaints on their social media. Some of those brokers have faced multi-down recessions lasting several days.

- We have faced three incidents in recent times. 1) Serious degradation of services on our platforms for ~ 20 minutes in early March during market closures. 2) 20 minutes intermittent drop of 20% traffic on our platforms two weeks ago. 3) A 7 minute intermittent drop of approximately 10% of traffic to our platforms earlier this week.

- While these unfortunate glitches are less compared to the issues faced by other brokers, the response in our case is exponentially higher as the amount of activity on our platforms is exponentially higher. Over 1 million users trade concurrently on our platforms and our systems handle more than one billion requests every day. The next largest broker probably has only a portion of this traffic. Many brokers claim their platforms are “100% uptime”, but the reality is that any complex system can develop issues for a number of infinite reasons.

- Our infrastructure needs to be reworked and we need to “add more servers”, a misconception of how a complex system works. The above numbers show the scale on which we work. Carpet can work in any system. (Google has had several global outages over the past few months and Robinhood, one of the largest brokers in the US, was down for several hours to several days). We have the most modern, robust technology stack in the industry. We recently had a Technical blog Has started, where we’ll talk about how we get it.

- It is not just our user-facing platforms that are robust, internally, dozens of back-office and backend systems that we use to manage our business (account opening, process, compliance and legal, sales, support Etc.) are also manufactured.

Highly streamlined, with precise access control and a large amount of automation. This enabled us to operate all of our 1200 employees from remote access home overnight on 12 March.

Client base

- 2.3+ million subscribers, acquired by word-of-mouth through all happy customers. We have never advertised online anywhere, while this is the norm in the industry.

- With 1.2+ million monthly active customers, we are the largest retail broker in India in terms of active customers and trading volume.

- अनुपात The ratio of complaints to our active customers on the exchanges is one of the lowest in the industry.

Risk management

- We are among the most conservative brokerage firms in the country in terms of leverage. This ensures less operational risk for the business.

- We have the same risk management policy for all our customers. No special deals for anyone. Thus, the risk management system is lean and the probability of something going wrong is much lower than in industry standard practice where some high net worth customers get special risk rules.

- We cater to the largest number of retail traders in India. There are no institutional or ultra HNI customers holding large risk positions with us. Due to our sheer size, every aspect of our business is frequently audited by many regulators throughout the year. All three exchanges, depositories and SEBI.

- We do not have relationship managers and not a single person from our 1200 member team has revenue targets. This ensures that there is no pressure on anyone to generate brokerage by motivating clients to trade.

- We recently introduced a new system, Nudge, which was to block scammy penny stocks and illiquid option contracts, which may be mis-sold by unregulated advisors / tipsters. Nudge also informs customers of safe trading practices that they follow while doing business. We are probably the first broker to turn clients away from trading if there are others.

The brand

- Zeroda has become a widely popular and trusted brand in the last ten years, based solely on the quality of our services and products.

- We have won the “Best Broker” award several times from multiple exchanges.

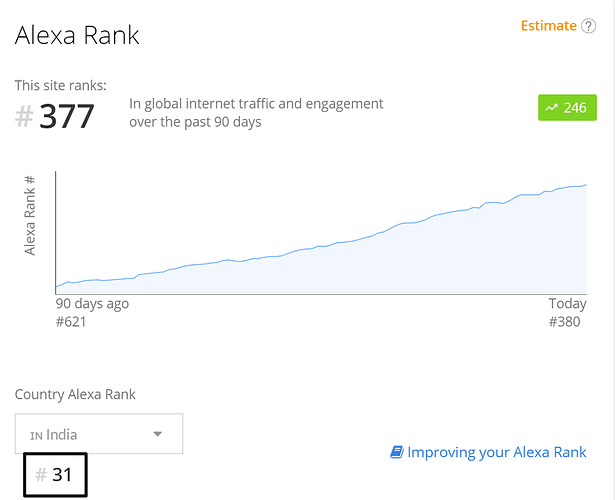

- Zerodha.com is the 31st largest website in India and 377th in the world (data from Alexa).

Zerodha.com ranks number 31 in India on Alexa

- We are the world’s top 15 investment related Among the websites.

- The Google Trend graph below shows how our brand has outpaced our competition over the past decade with zero advertising.

Google Trends for top Indian brokers for the past 10 years

I hope all the above factors give you comfort that you should remove any doubts about how safe your money and investments are with Zerodha. We are a solid business with consistent profits. You have nothing to worry about.

COVID-19 has caused havoc all over the world and we help the community Try your best are doing. We Catto But a fundraiser has also been set up so that daily wage earners can get the necessary help which they can no longer afford due to the lockdown. Click here to donate whatever you can to help us achieve this goal. We will match your donation 100%, and affect it 2x.