Suraksha Bima Yojana PM Apply | Prime Minister Suraksha Bima Yojana online application | PMSBY Application Form | Pradhan Mantri Suraksha Bima Yojana Registration

Pradhan Mantri Suraksha Bima Yojana The announcement was made by the Finance Minister of the country Arun Jaitley on the year 2015 after which it was formally launched on 8 May 2015 by the Prime Minister of our country, Shri Narendra Modi. This scheme has been started keeping in mind the poor and economically poor families of the country. Under this scheme, accident insurance will be provided to the people of the country by the central government. Suraksha Bima Yojana Under the government, the poor and poor people of the country will have to pay a premium of only Rs 12 annually to get insurance. After that you can avail the Pradhan Mantri Suraksha Bima Yojana.

PM Suraksha Bima Yojana

Under this scheme, if a person insures his accident and he dies, then the amount of money that the person has insured is given to his family or nominee as a cover. If a person dies in a road accident or any other accident. So his family will be provided insurance up to Rs 2 lakh. And if a person is temporarily handicapped (one leg, hand, eye) in the accident, then he will be provided security insurance up to Rs 1 lakh. this Suraksha Bima Yojana There is an accident insurance plan. Dear friends, today we are going to provide you all the information related to the scheme like application process, eligibility, documents etc. through this article of ours.

Prime Minister Jeevan Jyoti Insurance Scheme

Purpose of Pradhan Mantri Suraksha Bima Yojana

As you know, there are many people in the country who are unable to get their insurance due to being economically poor. Whenever such a person dies in an accident, his entire family starts struggling with financial crisis. Apart from this, they are not able to pay any type of insurance plans available with private or public sector insurance companies, so all of them Pradhan Mantri Suraksha Bima Yojana Is entitled to Under this scheme, if a person insures his accident and he dies, then the amount he has insured is given to his family or nominee as a cover.

Pradhanmantri Suraksha Bima Yojana Highlights

| Name of scheme | Pradhan Mantri Suraksha Bima Yojana |

| Started by | By Prime Minister Shri Narendra Modi |

| Launch date | Year 2015 |

| Beneficiary | Poor people of the country |

| an objective | Providing accident insurance |

Atal Pension Yojana

Pradhan Mantri Suraksha Bima Yojana Termination

Prime Minister Suraksha Bima Yojana can be availed till the age of 70 years. If the beneficiary age is 70 years or more, then the Pradhan Mantri Suraksha Bima Yojana will be terminated. If the beneficiary has closed the bank account, then the Pradhan Mantri Suraksha Bima Yojana will be terminated. If there is not enough balance in the beneficiary’s account to pay the premium, then in this case also the account will be terminated under this scheme.

Funds to be given in PMSBY

| Insurance Of Event | Insurance Of Amount |

| Death | 2 lakh rupees |

| In case of complete or non-recoverable position of both eyes or inability to use both hands or feet or loss of sight of one eye and inability to use one hand or foot | 2 lakh rupees |

| In case of the loss of sight of one eye and the inability to return or to use one hand and foot | 1 lakh rupees |

Pradhan Mantri Suraksha Bima Yojana benefits of

- The benefits of this scheme will be provided to all sections of the country, but especially the backward and poor sections of the country will be benefited.

- If a person dies in a road accident or any other accident. So up to Rs 2 lakh accident insurance will be provided to his family by the government.

- Permanently partial crippling provides a cover of Rs 1 lakh.

- If he is temporarily disabled in the accident, then he is given an insurance cover of up to one lakh rupees.

- Pradhan Mantri Suraksha Bima Yojana Under this, the policyholder will have to pay a premium of Rs 12 annually. Only then will he be entitled to security insurance.

- Apart from this, they are not able to pay any type of insurance plans available with private or public sector insurance companies, then they are all entitled to this scheme.

- Pradhan Mantri Suraksha Bima Yojana will be renewed every year with a cover for one year.

- Bank this PMSBY Can engage any insurance company of your choice to offer.

- Especially people living in rural areas of the country. Pradhan Mantri Suraksha Bima Yojana Provides insurance to them.

Pradhan Mantri Suraksha Bima Yojana

- Applicant must be resident of India.

- Pradhan Mantri Suraksha Bima Yojana Under the applicant, the age should be from 18 years to 70 years, it should not be more than this.

- The candidate must have an active savings bank account.

- The applicant has to sign a consent form for auto debit of the policy premium.

- The entire 12 premiums will be deducted simultaneously on 31 May every year.

- The policy will end in case of bank account closure.

- The policy cannot be renewed if the premium is not deposited.

Pradhan Mantri Suraksha Bima Yojana Documents

- Applicant’s Aadhar Card

- identity card

- Bank account passbook

- Age certificate

- income certificate

- mobile number

- Passport size photo

How to apply for Pradhan Mantri Suraksha Bima Yojana?

Interested beneficiaries of the country who want to avail the benefits of this scheme can go to any branch of the bank and apply under this scheme.

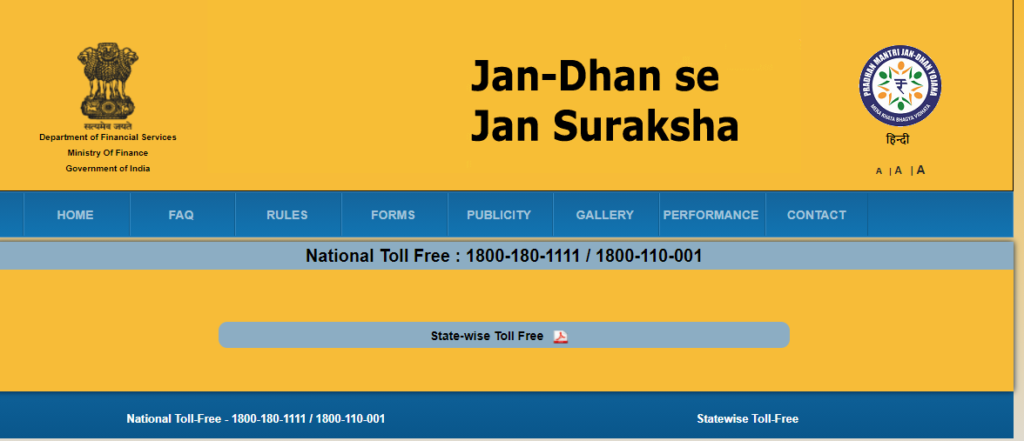

- If you want to download the application form, then you must first Official website Have to go on

- After visiting the official website, the home page will open in front of you.

- On this home page Forms The option will appear, you will have to click on this option. After clicking on the option, the next page will open in front of you on the computer screen.

- On this page you Prime Security Insurance Have to click on the option of After this, you have to click on the option of application form.

- Then the PDF of the application form will open in front of you. You Application Form PDF Download After this, you have to fill all the information asked in the application form like name, address, Aadhaar number, email id etc.

- After filling all the information, you will have to attach all your documents with the application.

- Then you have to submit the application form to the bank.

Procedure for checking the status of Pradhan Mantri Suraksha Bima Yojana application

- You got the Pradhan Mantri Suraksha Insurance Scheme Official website will go on.

- Now the home page will open in front of you.

- On the home page, you have to click on the link to see the application status.

- Now a new page will open in front of you.

- You have to enter the application number on this page.

- Now you have to click on the search button.

- The application status will be on your computer screen.

State wise toll free number lookup process

- As soon as you click on this link, you will have a state wise toll free number.

Procedure for viewing the beneficiary list of Pradhan Mantri Suraksha Bima Yojana

- First of all you have the Pradhan Mantri Suraksha Bima Yojana Official website will go on.

- Now the home page will open in front of you.

- On the home page you have to click on the link of the beneficiary list.

- Now a new page will open in front of you in which you will have to select your state.

- Now you have to select your district.

- After that you have to select your block.

- The beneficiary list will be on your computer screen.

Contact Information

We have given you this article Pradhan Mantri Suraksha Bima Yojana Has provided all the important information related to If you are still facing any kind of problem then you can solve your problem by contacting the helpline number. The helpline number is 18001801111/1800110001.